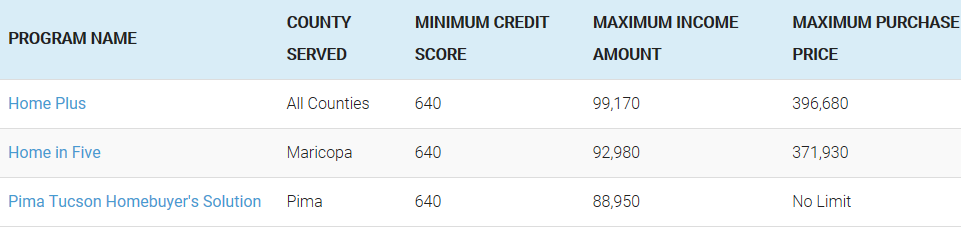

The following chart is provided as a summary of the basic qualifying features of the most popular Arizona Down Payment Assistance programs. These programs are made available to help responsible Arizona home buyers who struggle to save for a down payment buy a home with as little money out of pocket as possible. More detail of each program is provided in the content below.

UPDATED MAY 21, 2018

HOME PLUS MORTGAGE PROGRAM

HOME PLUS MORTGAGE PROGRAM

The Arizona Home Plus mortgage program has been updated to offer a greater variety of opportunities to Arizona home buyers who need down payment assistance. These expanded options include different down payment amounts, higher maximum loan amounts and income limits, different loan programs, and different qualifying criteria.

The Arizona Home Plus home loan program is very popular because the funds have been consistently available over the past few years. As such, many people in Arizona have been able to achieve the pride, stability, freedom and wealth that accompanies home ownership. The assistance program is structured as a three-year, no interest, no payment, soft second mortgage, forgiven monthly at a rate of 1/36 over the term of the lien. Once again, the lien is completely forgiven after you stay in the home for three years without refinancing. This type of lien is sometimes referred to as a silent second because you do not have to pay interest or make payments. Money from the Home Plus assistance is combined with government-sponsored mortgage programs and can be used for down payment and/or closing costs equal to as much as 5% of the mortgage loan.

Program Highlights:

- There isn’t a minimum amount that you have to provide to close. The down payment assistance can potentially cover all of your down payment and closing costs.

- No first time home buyer requirement for most programs.

- The assistance money received is a silent second that has no interest, no payment and is forgiven monthly over the first three years of home ownership. The lien is completely forgiven after you stay in the home for three years without refinancing. The purpose of the silent second is to provide stability and ensure the ongoing success of the Home Plus Assistance Program in Arizona.

- Qualified members of the U.S. military (active and Veterans) are eligible for an additional 1% of down payment assistance.

- The money continues to be consistently available.

How to Qualify:

- Maximum purchase price of $396,680. If using an FHA loan with Home Plus, the maximum loan amount depends on the FHA loan limits in your county.

- Maximum income of $99,170.

- Maximum debt-to-income of 45%

- See various loan program requirements below.

ARIZONA HOME PLUS CONVENTIONAL LOAN PROGRAMS

Conventional loans with down payment assistance can be a great option because unlike some other loan programs, conventional loans allow you to remove the private mortgage insurance (typically on loans with less than 20% down) down the road.

Home Plus Fannie Mae HFA Preferred Loan Program

This program is derived from the Fannie Mae HomeReady program and is one of the Arizona conventional Home Plus loan programs offered. It is offered anywhere in Arizona.

Program Highlights:

- Down payment assistance options between 1% and 5%. You can choose what is best for you based on your loan scenario.

- Minimum FICO score is 640

- Maximum purchase price of $396,680

- Maximum debt-to-income of 45%

- Maximum income of $99,170

Home Plus Freddie Mac HFA Advantage Loan Program

This program is derived from the Freddie Mac Home Possible Advantage program and is the other Arizona conventional Home Plus loan programs offered. It is offered anywhere in Arizona.

Program Highlights:

- Down payment assistance options between 3% and 5%

- Minimum FICO score is 640 with 3% down

- Maximum purchase price of $396,680

- Maximum debt-to-income of 45%

- Maximum income of $99,170

ARIZONA HOME PLUS GOVERNMENT LOAN PROGRAMS

Government loan programs with Home Plus down payment assistance can be a great option because they usually have easier qualifying requirements. The three common government loan programs are FHA, USDA, and VA.

Home Plus VA & USDA Loan Programs

VA and USDA loans are two popular government loan programs that offer 100% financing. Since there is no down payment requirement, the assistance money from the Home Plus program is instead used to cover closing costs. As such, you can buy your home with little to no money out of pocket. Home Plus VA and USDA Loan Programs are great Arizona zero down loan programs They are offered anywhere in Arizona.

Program Highlights:

- Down payment assistance of 2% is available when used with a USDA loan.

- Down payment assistance of 3% is available when used with a VA loan.

- Minimum FICO score is 660.

- Maximum purchase price of $396,680.

- Maximum debt-to-income of 45%

- Maximum income, per program guidelines, of $99,170.

- You must also meet the guidelines required to be approved for the VA or USDA loan.

Home Plus FHA Loan Program

FHA loans with down payment assistance in Arizona are popular because of their flexibility and other benefits. They still have many advantages that make them attractive to Arizona first time homebuyers. The Home Plus FHA loan program is offered anywhere in Arizona.

Program Highlights:

- Down payment assistance options of 3%, 4% and 5%. You can choose what is best for you based on your loan scenario.

- Minimum FICO score is 640.

- Maximum purchase price of $396,680. If using an FHA loan with Home Plus, the maximum loan amount depends on the FHA loan limits in your county.

- Maximum debt-to-income of 45%

- Maximum income of $99,170

HOME IN FIVE ADVANTAGE

HOME IN FIVE ADVANTAGE

If you are buying a house in Maricopa County and you need help with your down payment and closing costs, you should consider the Home In Five Advantage program. This program has been very popular and used by home buyers in Phoenix and other parts of Maricopa County for more than five years.

Simply put, this is a great down payment assistance program.

Program Highlights:

- Assistance for down payment and/or closing up to 3%. An additional 1% is available to qualified Veterans, active duty Military, active Reservists and active National Guard.

- The assistance money is actually available. Many down payment assistance programs run out of funds within a short period of time.

- The Home in Five assistance money received is a silent second that has no interest, no payment and is forgiven monthly over the first three years of home ownership. The lien is completely forgiven after you stay in the home for three years without refinancing. The purpose of the silent second is to provide stability and ensure the ongoing success of the Home in Five down payment assistance program in Arizona.

- You do not have to be a first-time home buyer.

How to Qualify:

- Buy a house anywhere in Maricopa County, including in the City of Phoenix up to $371,930.

- New or existing single-family homes, 2 to 4 unit homes, condos, and townhomes.

- Qualify for an FHA, VA or USDA loan with a maximum debt-to-income ratio of 45%.

- Minimum FICO score is 640.

- Income from all borrowers may not exceed $92,980.

- Take a convenient homebuyer education course.

PIMA TUCSON HOMEBUYER’S SOLUTION

PIMA TUCSON HOMEBUYER’S SOLUTION

The Pima Tucson Homebuyer’s Solution helps overcome barriers so you can buy a home in Tucson, Arizona. The benefits are similar to those offered by the programs listed above and are offered in all of Pima County including the City of Tucson.

There is no purchase price limit to this program other than the maximum amounts of the loan program that you choose. For example, in 2018, the maximum FHA loan amount in Pima County is $294,515. Household income cannot exceed $83,020 when using an FHA, VA or USDA loan. If you are using the homebuyer assistance money with a conventional loan, the maximum income limit is $88,950.

A Pima Tucson Homebuyer’s Solution conventional loan program is now offered through the both the Fannie Mae FHA Preferred loan program and the Freddie Mac FHA Advantage loan program.

Program Highlights:

- Down payment assistance options available at 3%, 4% and 5%. You can choose what is best for you based on your loan scenario.

- There is no first-time homebuyer requirement.

- Assistance money received through the Pima Tucson Homebuyer’s Solution is a silent second that has no interest, no payment and is forgiven monthly over the first three years of home ownership. The lien is completely forgiven after you stay in the home for three years without refinancing. The purpose of the silent second is to provide stability and ensure the ongoing success of the down payment assistance program in Tucson and all of Pima County.

- The assistance money offered to help you buy a home in Tucson or other parts of Pima County has been consistently available and has continuous funding.

How to Qualify:

- Qualify for an FHA, VA, USDA or conventional loan with a maximum debt-to-income ratio of 45%.

- Minimum FICO score is 640. Some of the different mortgage programs and down payment amount scenarios may require a higher score.

- Household income cannot exceed $83,020 for FHA, VA or USDA loan programs.

- Household income cannot exceed $88,950 for conventional loan programs.

- Take a convenient homebuyer education course.

CHENOA FUND

CHENOA FUND

The CHENOA Fund is an affordable housing program teaming with quality, delegated mortgage companies to assist their borrowers to obtain the 3.5% minimum required investment on an FHA loan. This partnership is on a correspondent basis to provide Down Payment Assistance for qualified home buyers in the form of Second Mortgages. All assistance is provided in compliance with FHA guidelines.

The program offers 3 different options depending on income level.

A GIFT that does not have to be repaid for up to 3.5% towards down payment if the household income is below 115% of the median income for the county. If you couple this with an FHA loan that ONLY requires a 3.5% down payment, then you could be getting into a home with No Money Down.

A Forgivable 2nd Loan also offers the 3.5% assistance towards down payment if the household income is below OR equal to the 115% of the median income for the county. What makes this option also GREAT is that if you make 36 [3 years] consistent payment On-Time, then the lender forgives your loan altogether.

A Repayable 2nd Loan offers the same 3.5% assistance towards down payment if the household income is ABOVE the 115% of the median income for the county. So, this is a second loan, and often times a better alternative than having to ask a family member for the money. This second loan is repayable over 30 years and at ONLY a 5% interest rate.

” Remember, if you are over the income limit and use the repayable option, you can choose to pay it back in 10 years instead of 30, and if you do, then the program has 0% Interest. So, this is kind of like borrowing from a family member.”

Barbara Heiser – Sr. Loan Officer

As a Loan Officer, I think this is an exciting program because it provides potential buyers with more options and opportunities. If the buyer can get the gift or forgivable loan, then this offers them the opportunity to purchase their home with nothing down. I mean who doesn’t like free money right?

Also, for a lot of clients who are above the income limits, but still have a tough time coming up with the down payment, now they have an option at 0% or a 5% interest rate. In the past, I had to deliver the bad news to clients that they were not eligible for the traditional down payment programs. Now there are more options available!

Borrower Qualifications

- No Income Limit

- Credit score as low as 620

- Available in ALL Counties

- Homebuyer education not required

- Do NOT have to be a first-time homebuyer

Benefits for Borrowers

The Chenoa Fund program has some great benefits that you should consider taking advantage of if you are even starting to consider a future home purchase:

- You can buy a home with No Money Down

- You may be able to afford a home in a higher cost area than you anticipated

- You may be able to buy a home much sooner than you expected

- You can get the most flexibility for maximum financing

We’re really excited to be able to offer this new Chenoa Fund program to our borrowers! Being able to buy a home with no money down will help many more families fulfill their homeownership dreams.

Does 100% mortgage financing mean you can now afford to start your homeownership journey? Contact Barbara Heiser and She’ll walk you through the details and help you get started. We’re here to answer your questions and simplify the process – contact us today!

Most mortgage lenders in Phoenix will approve conventional loan requests with a down payment as low as 3% of the property purchase price. However, many lenders will not consider you without a down payment of at least 20% of the total mortgage. Keep in mind that the figure is not universal and may vary from lender to lender.